Escaping the Paid Growth Trap: How Product-Led Growth Beats Paid Ads 10:1

The growth strategy that gets stronger as marketing costs rise [Slides Included]

The bottom line: Most companies burn money on paid ads while their competitors grow organically at 10x lower cost. The secret isn’t more budget—it’s building products people want to share.

When Asya Kuznetsova was first tasked with “grow through word of mouth,” she was puzzled. How do you control what someone somewhere tells someone about your product? How do you measure dark matter?

Today, as Sr Group Product Lead at Kraken, Asya has cracked the code. Her teams have consistently achieved 70-95% organic growth by treating word-of-mouth not as luck, but as a buildable system.

At ProductLab Conference Berlin 2025, she shared the exact playbook that helped fintech companies scale from millions to hundreds of millions of users—without burning through ad budgets.

Why Word-of-Mouth Matters More Than Ever

In a world drowning in paid ads and AI-generated noise, people still trust people.

Consider these cases:

→ Notion grew from 4M to 20M users in one year. 95% came through shared templates—essentially free word-of-mouth built into the product.

→ Spotify hit 650M users largely through social features. When you click “create” in Spotify, 3 out of 4 options involve friends.

→ Multiple fintech companies achieved 70%+ organic acquisition by building sharing directly into their core user journeys.

The companies you still use today? They’re probably the ones you discovered through word-of-mouth—because they were designed for it.

The Three Pillars of Word-of-Mouth Growth

Most companies hope for word-of-mouth. Smart companies design for it.

Asya’s framework has three components:

1. Organic Recommendations

These happen when customers notify others about your product simply by using it.

Examples: → When Spotify users share songs on Instagram, non-users see that their friends prefer Spotify → When fintech users send money, recipients get branded notifications showing benefits and savings → When Notion users share templates, they’re distributing free marketing

Think about your product: What features would automatically notify others when customers use them?

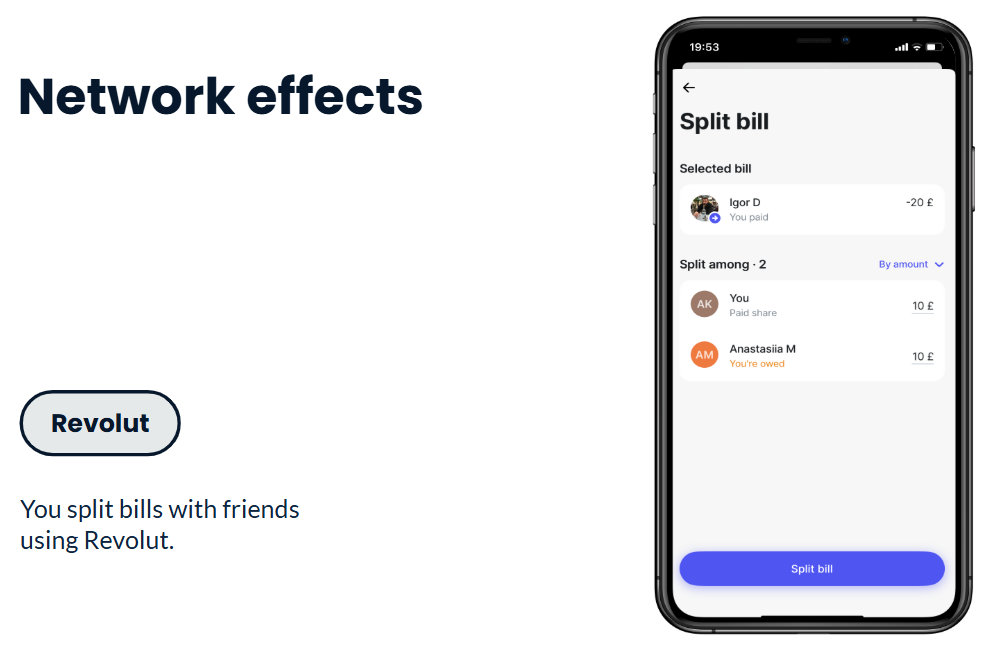

2. Network Effect Features

Build features that make your product more useful when others join.

Real examples from fintech: → Revolut’s “split the bill” feature—pay at restaurants, split in-app, friends pay you back instantly → Monzo’s group expense management—roommates pool expenses, easily settle up → Payment request features—one click to sync contacts, one click to request money

Customers invite friends not for rewards, but because the product becomes more valuable with them on it.

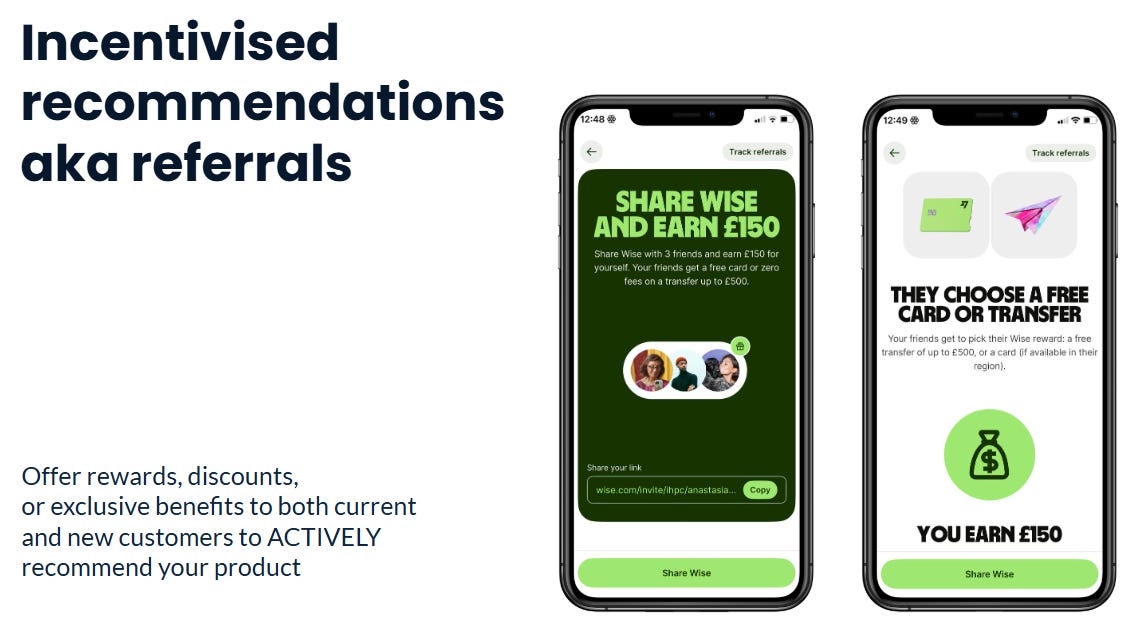

3. Incentivized Referrals

This is where most companies fail—they just throw money at customers hoping they’ll invite friends.

The key? Connect referrals to customer journeys.

Asya’s research revealed customers in fintech primarily recommended products for travel. So the entire referral program pivoted: “Invite friends to travel, give them a free travel card, earn cash rewards for travel.”

Result: Referral conversion improved several times over generic “invite a friend” programs.

The Referral Multiplication Effect

Here’s why referrals are the fastest path to impact:

John loves your product. You incentivize him to invite friends. He invites 5 people and gets rewarded.

John feels appreciated and becomes more likely to recommend again.

His friends receive incentives to try. They love the product because it came from someone trusted. They become loyal customers.

John’s friends are now more likely to recommend because they came through recommendation themselves.

John’s 5 friends bring 25 more. Those 25 bring 125. Exponential growth.

Dropbox proved this works at scale: they grew 40x in 15 months (100K to 4M customers) through a simple referral program.

The Recipe for Successful Referrals

Most referral programs fail because they’re disconnected from customer journeys. Here’s Asya’s tested recipe:

Step 1: Match customers in their first weeks

Send referral prompts when customers are in their “aha moment”—when they’ve just experienced core value and want to share.

Step 2: Give clear direction

Instead of generic “invite friends,” be specific: → “Invite friends to [specific use case]” → “Give them [specific benefit they’ll understand]” → “Earn [clear reward]”

Context removes the main blocker and improves conversions several times.

Step 3: Connect referrals to other social features

When you share a payment link, attach a referral link. When you split a bill, attach a referral link. When you connect all word-of-mouth features, they multiply each other’s growth.

Referrals are never standalone—they’re part of your entire social ecosystem.

Step 4: Maintain healthy economics

Manage referrals by payback period: how fast do you earn revenue from invited customers compared to reward costs?

Two levers to pull: → Decrease reward cost (variable rewards: “up to €50” where only small percentage gets top amount) → Increase invited customer revenue (require actions that correlate with retention to claim rewards)

For example, one fintech company found customers who spent €200 had healthy retention. To claim referral rewards, invited customers must spend €200—aligning incentives with business health.

The Cultural Challenge

One audience member raised an important point: cultural differences matter.

In Brazil, people share referral links freely across any channel. In Germany, people feel uncomfortable referring others for personal benefit.

Asya’s insight: When you talk to customers who don’t share referral links, they’re often motivated by helping others—but the money component feels uncomfortable.

The solution? Build referral mechanics that feel like genuine favors, not ads. Frame benefits around helping friends discover value, not earning bounties.

The Retention Advantage

A critical question from the audience: Do referred customers actually stick around, or is it just bounty hunting?

Asya’s data across multiple companies: Retention for invited customers is consistently higher than for customers from other channels.

Why? They came through trusted recommendations. They had better onboarding experiences. They joined with context about the product’s value.

B2B Referral Strategy

Growing B2B through referrals is harder—businesses have more barriers, they fear reputation damage.

Asya’s workaround: Target third parties who work closely with your customers but aren’t direct clients.

Examples: → Accounting firms that work with your business customers → Real estate agents who interact with your user base → Industry consultants who make regular recommendations

These intermediaries will recommend your product for incentives with much lower risk than asking your customers to become evangelists.

The New Growth Playbook

Every great company Asya knows didn’t rise to the top by outspending competitors on ads.

They succeeded because customers spread the word. The smartest ones didn’t wait for it to happen—they designed for it.

If you want exponential growth:

Build something customers want to talk about

Give them the tools to do it

Connect those tools to natural user journeys

Make sharing feel like helping, not selling

This approach cuts acquisition costs 10-fold while building defensible growth.

In rising competition, marketing costs skyrocket. Companies burn through money just keeping up with competitors.

But in a world full of noise and paid ads, people still trust people. And now with AI shifting standards, authentic word-of-mouth becomes more vital than ever.

Connect with Asya: Follow her on LinkedIn where she regularly shares growth insights. She’s currently hiring a Senior PM at Kraken to work on exactly these topics.